Understanding the Fundamentals: What Are Lab and Natural Diamonds?

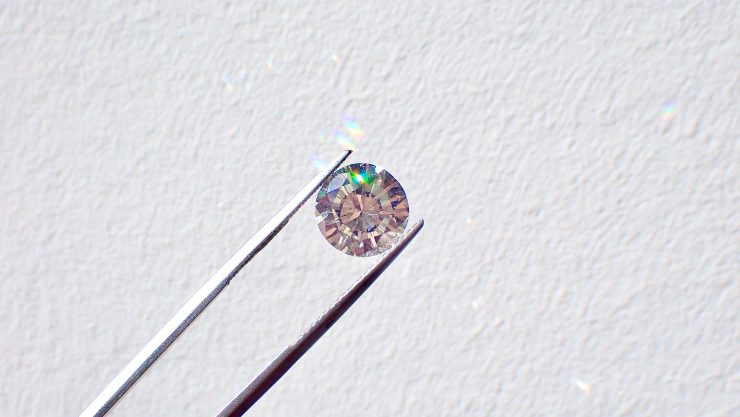

Before delving into pricing and value comparisons, it is crucial to understand the fundamental differences between lab-created and natural diamonds. Natural diamonds are formed over billions of years under extreme heat and pressure deep within the Earth’s mantle. They are extracted through mining operations and undergo extensive grading, certification, and cutting processes before reaching the market. In contrast, lab-created diamonds, also known as synthetic or man-made diamonds, are produced in controlled laboratory environments using methods such as High Pressure High Temperature (HPHT) or Chemical Vapor Deposition (CVD). These methods replicate the natural diamond formation process, producing diamonds that are chemically, physically, and optically identical to their natural counterparts. As such, both types of diamonds are composed of pure carbon atoms arranged in a crystalline structure, but their origin distinguishes them in terms of cost, availability, and perceived value.

Production Costs and Market Supply Dynamics

The significant cost difference between lab and natural diamonds largely stems from production methods and supply chains. Extracting natural diamonds involves costly mining operations, environmental management, labor regulations, transportation logistics, and complex international trade procedures. These factors contribute to the higher base cost of natural diamonds, which is further influenced by their rarity. On the other hand, lab diamonds can be produced in weeks with far less logistical complexity. Once the technology and infrastructure are in place, labs can create diamonds on a large scale, reducing the marginal cost of production over time. Moreover, as lab-grown diamond production becomes more efficient and widespread, the supply continues to grow, placing downward pressure on prices. Therefore, while both types of diamonds may look identical to the naked eye, the disparity in production cost directly affects their market prices.

Price Differences: Analyzing Retail and Wholesale Markets

Retail pricing of lab-grown diamonds is typically 40% to 70% lower than that of natural diamonds with similar specifications (cut, color, clarity, and carat weight). For instance, a 1-carat lab diamond may retail for $1,000 to $2,000, while a natural diamond of the same grade could cost between $4,000 and $7,000. Wholesale markets reflect similar proportions, albeit at lower absolute values due to bulk transactions. One reason for this discrepancy is the perceived rarity and historical value of natural diamonds, which has allowed suppliers to maintain high markups. Retailers also tend to invest more in marketing and branding for natural diamonds, which increases consumer willingness to pay a premium. Additionally, some retailers may offer fewer discounts or financing options for lab diamonds, assuming they are already competitively priced. The significant difference in pricing presents an opportunity for budget-conscious consumers but also raises questions about long-term resale value and investment potential.

Resale and Long-Term Value Considerations

One of the most frequently cited concerns regarding lab-created diamonds is their limited resale value. Natural diamonds, particularly those with desirable grades and certifications, tend to retain a portion of their value over time. Although they are not considered strong investments like real estate or stocks, natural diamonds can sometimes be resold through jewelers, auctions, or secondary markets for a price that reflects their enduring market demand and limited supply. In contrast, lab diamonds often depreciate significantly after purchase and may command very low resale prices, if any. This depreciation is mainly driven by their abundant supply, lack of perceived rarity, and the rapidly evolving lab diamond market, which constantly produces better-quality stones at lower prices. As a result, those who view diamond purchases through the lens of investment or long-term value preservation often gravitate toward natural diamonds, despite their higher upfront cost.

Consumer Perception and Psychological Value

Another aspect influencing value is consumer perception. For decades, natural diamonds have been culturally positioned as symbols of enduring love, luxury, and status, largely due to successful marketing campaigns by industry leaders like De Beers. This cultural significance contributes to a higher psychological and sentimental value associated with natural diamonds. In contrast, lab-grown diamonds are often seen as practical alternatives, especially among younger generations who prioritize ethical sourcing, environmental sustainability, and affordability. However, this shift in sentiment is still evolving. While some consumers are fully embracing lab-created stones, others view them as less prestigious or less meaningful due to their manufactured origins. This perception gap plays a significant role in pricing and resale dynamics, as the intangible qualities of luxury and status can heavily influence purchasing decisions, even when tangible characteristics are indistinguishable.

Technological Advancements and Their Impact on Lab Diamond Pricing

Technological progress in the lab diamond industry continues to influence pricing trends. As manufacturing techniques such as HPHT and CVD become more efficient and scalable, production costs continue to decline. This has led to a steady decrease in retail prices for lab-created diamonds over the past several years. In many cases, the same lab can now produce larger or higher-quality stones at lower costs than just a few years ago. Additionally, improvements in grading and certification standards for lab diamonds—offered by institutions such as the Gemological Institute of America (GIA) and International Gemological Institute (IGI)—have helped legitimize the product in the eyes of consumers. However, these advancements also contribute to a unique pricing dynamic: newer lab diamonds may be more advanced and affordable than older ones, causing previous purchases to lose market appeal. This situation is somewhat analogous to consumer electronics, where rapid innovation leads to depreciation. While this benefits new buyers with better value, it reinforces the perception that lab diamonds do not hold value over time.

Environmental and Ethical Considerations: A New Kind of Value

Although not directly tied to monetary price, environmental and ethical factors are increasingly relevant in assessing value, particularly among socially conscious consumers. Lab diamonds are often marketed as an eco-friendly and ethical alternative to natural diamonds. Unlike traditional diamond mining, which can involve habitat destruction, water usage, carbon emissions, and potential human rights violations, lab diamond production has a significantly smaller environmental footprint and avoids the controversies of “conflict diamonds.” This ethical advantage, while not quantifiable in resale price, may justify the purchase in the eyes of many buyers. Some consumers are even willing to pay a premium for lab diamonds that come with carbon-neutral certifications or sustainable production guarantees. This evolving definition of value—shifting from mere financial worth to encompass ecological and humanitarian concerns—is influencing demand and reshaping how both lab and natural diamonds are perceived in the marketplace.

Insurance and Appraisal: How Type Affects Coverage

Another often overlooked but financially relevant aspect of diamond ownership is insurance. When consumers insure their diamonds for loss, theft, or damage, appraisers evaluate the stone’s replacement cost and perceived value. Natural diamonds generally receive higher appraisals due to their market pricing and limited supply. Insurance premiums for these stones tend to be higher, reflecting their greater replacement cost. In contrast, lab-created diamonds receive lower appraisals, which can result in lower premiums but also mean that any loss payout would be considerably less. Some insurers may not even cover lab diamonds at full purchase value, given the expectation of continued price declines. This factor adds an additional layer to the long-term financial considerations of owning either type of diamond and is particularly important for those seeking to protect their jewelry as a valuable asset.

Market Trends and Future Outlook

The diamond market is undergoing a transformation driven by generational shifts, technological advancements, and changing social values. Younger consumers—especially Millennials and Gen Z—are more open to lab-created diamonds due to their affordability and ethical sourcing. As this demographic becomes a dominant purchasing force, demand for lab diamonds is expected to grow. Simultaneously, the luxury and bridal jewelry sectors continue to emphasize the prestige and tradition of natural diamonds, maintaining their stronghold among more traditional buyers. Analysts suggest that natural diamond prices may stabilize or increase in the long run due to depleting mine reserves and reduced exploration investment, while lab diamonds will likely continue to decline in price as supply increases. The widening gap in price and resale dynamics could further stratify the market into two parallel sectors: one centered around luxury and legacy (natural diamonds), and the other around value and ethics (lab diamonds).

Conclusion: Choosing Based on Purpose and Priorities

Ultimately, the price comparison between lab-grown and natural diamonds is not solely a matter of dollar value—it is a multifaceted decision involving purpose, priorities, and perspective. For consumers focused on affordability, aesthetics, and ethics, lab diamonds offer a compelling proposition: a visually identical product at a fraction of the price, produced sustainably and without ethical baggage. However, for those who place high value on tradition, rarity, long-term retention of value, and luxury status, natural diamonds still hold unmatched appeal, albeit at a significantly higher cost. By understanding the full spectrum of factors—production economics, resale value, cultural perception, and sustainability—consumers can make informed decisions that align with both their financial goals and personal values. As the market continues to evolve, these distinctions may become even more pronounced, highlighting the need for continued education and transparent comparisons.