Understanding Legal Ownership and Proof of Possession

Before engaging in the sale of any diamond—whether it’s a loose stone, a set piece of jewelry, or part of an estate collection—the first legal consideration is ownership. In most jurisdictions, only the rightful owner of the diamond or an authorized representative (such as an executor of an estate or a person with power of attorney) may legally sell it. Documentation supporting ownership is crucial and can include original purchase receipts, appraisal certificates, insurance documents, or legal inheritance papers. Selling a diamond without clear proof of ownership can result in disputes, legal challenges, or even criminal accusations, especially if the diamond is suspected to be stolen or part of a legal estate under probate. Ensuring that all parties involved are confident in the chain of custody not only legitimizes the transaction but also builds trust with prospective buyers, whether private individuals or commercial entities. Sellers should retain copies of all relevant documentation and be ready to produce it upon request.

Complying With Anti-Money Laundering (AML) Regulations

Due to the high value and portability of diamonds, they are frequently scrutinized under anti-money laundering (AML) frameworks in many countries. In jurisdictions like the United States, the United Kingdom, and the European Union, diamond dealers and even some private sellers may be subject to AML compliance requirements, especially if they engage in regular or high-value transactions. These requirements often include identity verification of the buyer, transaction reporting, and record-keeping. For example, under the USA PATRIOT Act, dealers who purchase or sell more than $50,000 worth of precious stones annually must maintain an AML compliance program. Even if you are an occasional seller, being aware of these laws is essential. Failing to comply with AML standards can result in heavy fines or criminal liability. Moreover, buyers—particularly professional or institutional ones—may refuse to proceed with a transaction if the seller cannot provide sufficient identity and source-of-funds verification. Sellers should consider consulting a legal advisor to determine whether AML compliance applies to their particular transaction.

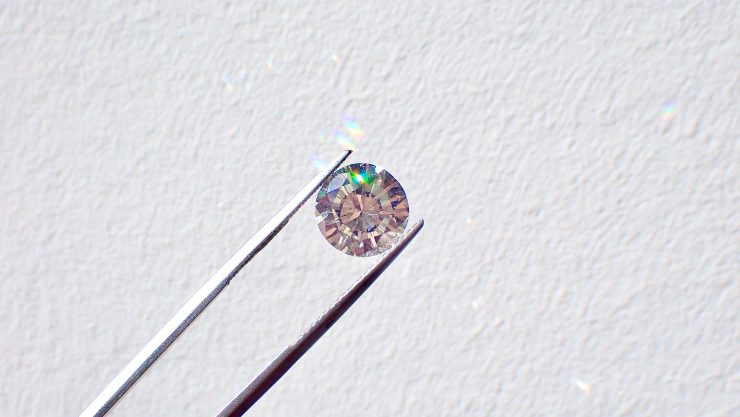

Verifying Diamond Authenticity and Certification

Legal and ethical sales of diamonds also require a verified declaration of the diamond’s authenticity. Reputable buyers will almost always request third-party verification of the diamond’s quality and characteristics, which is commonly provided through certification from recognized gemological institutes such as the Gemological Institute of America (GIA), the American Gem Society (AGS), or the International Gemological Institute (IGI). Selling a diamond without proper certification may not be illegal per se, but misrepresenting the diamond’s quality can result in civil liability for fraud or breach of contract. In some jurisdictions, it may even rise to the level of criminal fraud. A certification not only confirms carat, clarity, color, and cut but also ensures the diamond is natural and not lab-grown or treated unless explicitly disclosed. To protect both the buyer and seller, all specifications presented during the transaction should match the diamond’s certification exactly. This documentation will also help in establishing a fair market value and prevent post-sale disputes.

Taxation and Declaring Income From Sales

Another important legal element when selling diamonds is the taxation of proceeds. Depending on local tax laws, the sale of a diamond—especially at a profit—may trigger income tax, capital gains tax, or value-added tax (VAT). In the United States, for example, selling a diamond for more than its original purchase price is considered a capital gain and must be reported to the IRS. If the diamond was inherited or gifted, there may also be different tax treatment based on the fair market value at the time of transfer. In the European Union, VAT regulations may apply if the seller is a registered dealer or if the transaction occurs across borders. Sellers should maintain a record of the original purchase price, the date of acquisition, and documentation of any appraisals or improvements. Consulting with a tax advisor or accountant familiar with jewelry sales can help ensure full compliance and avoid legal issues related to underreporting or tax evasion. Ignoring tax obligations can lead to audits, penalties, and even criminal charges in severe cases.

Dealing With Conflict Diamonds and Ethical Sourcing

A seller must also be aware of international regulations concerning conflict diamonds—diamonds that are mined in war zones and sold to finance armed conflict against governments. The Kimberley Process Certification Scheme (KPCS) was established to prevent the trade in these diamonds, and most countries now require some form of assurance that diamonds entering the market are conflict-free. While the Kimberley Process mostly targets rough diamonds and wholesalers, sellers of cut and polished diamonds should still be cautious. Selling a diamond without verifiable ethical sourcing documentation can harm reputations and may even involve legal repercussions in countries with strict import/export controls. Buyers, especially institutional and retail jewelers, often demand certification proving that a diamond complies with ethical standards. Some buyers may also request a written declaration from the seller affirming that the diamond was not sourced from conflict regions. For peace of mind and legal protection, sellers should research the origin of their diamonds and retain any provenance documentation they can obtain.

Import and Export Laws for International Sales

When diamonds are sold across international borders, the legal complexity increases significantly due to the involvement of customs, international trade regulations, and potential export/import duties. Many countries have specific laws governing the import and export of gemstones, including licensing requirements, tax declarations, and mandatory documentation such as Kimberley Process certificates for rough stones. Even for polished diamonds, some jurisdictions require a declaration of value, proof of ownership, and assurance of non-conflict origin. For instance, the United States requires imported diamonds over a certain value to be declared to U.S. Customs and Border Protection, and similarly, the European Union applies VAT and customs codes to diamond transactions. Failure to comply with international trade laws can result in seizure of the item, fines, or criminal penalties. Additionally, shipping diamonds internationally demands careful handling with specialized insurance and courier services that meet legal standards for valuable goods. Sellers should engage with legal advisors or customs brokers when navigating international sales to ensure compliance with all applicable laws and to avoid logistical or legal setbacks.

Transparency and Disclosure Requirements

One of the most important aspects of a legitimate diamond transaction is transparency. Legal and ethical standards dictate that sellers must fully disclose any and all information relevant to the condition, composition, and history of the diamond. This includes whether the stone has been treated (e.g., clarity-enhanced), if it is lab-grown rather than natural, if it has undergone any laser drilling, or if there are inclusions not visible to the naked eye. Non-disclosure of such information can lead to accusations of misrepresentation or fraud, which may carry legal consequences depending on local consumer protection laws. In the United States, the Federal Trade Commission (FTC) has issued guidelines on how diamonds should be described in marketing and sales communications, prohibiting misleading claims and requiring accurate terminology. Professional buyers and informed consumers will often rely on disclosures to make purchasing decisions, and a lack of transparency can also result in a damaged reputation or legal action. Full written disclosure, ideally supported by independent gemological documentation, offers protection for both parties in case of disputes.

Contracts and Sales Agreements

Using a formal sales contract or agreement is another legal safeguard when selling diamonds, especially for high-value transactions. While casual private sales may be conducted informally, this approach is risky and often discouraged. A proper sales agreement should outline the identity of the buyer and seller, a full description of the diamond (preferably referencing certification details), the agreed-upon price, the method and timing of payment, and terms regarding returns, warranties, or disputes. The inclusion of legal disclaimers and representations from both parties can help establish intent and clarify obligations. For sellers working with auction houses, jewelers, or consignment dealers, contracts are often standardized but should still be carefully reviewed for clauses about commissions, liability, and authenticity guarantees. In some cases, notarization or the presence of legal witnesses may further solidify the enforceability of the agreement. Having a written contract ensures that the transaction is documented, reduces ambiguity, and provides critical evidence should legal disputes arise later on.

Working With Licensed Professionals

Another prudent legal consideration when selling diamonds is engaging with licensed and credentialed professionals. These can include appraisers, gemologists, brokers, auctioneers, and jewelers who adhere to professional and ethical standards. Many countries require diamond dealers and appraisers to hold specific licenses or certifications issued by gemological institutions or regulatory bodies. Sellers who work with such professionals reduce their legal exposure by ensuring that valuation, marketing, and sales practices are compliant with applicable laws. Furthermore, these professionals can offer valuable guidance on market pricing, legal documentation, and the logistics of a secure transaction. Engaging reputable experts also demonstrates due diligence, which can serve as a legal defense in cases where a transaction is later challenged. For particularly valuable or rare diamonds, it may even be appropriate to retain a legal advisor to review contractual terms, tax implications, or provenance issues. By involving licensed professionals, sellers enhance both the legality and the credibility of their transaction.

Preventing Fraud and Ensuring Personal Security

Fraud is a major concern in the diamond trade, particularly in private sales or online transactions. Legally, sellers have an obligation to ensure that the buyer is legitimate, that payment methods are secure, and that any intermediaries involved are trustworthy. Accepting cash, unverified checks, or non-traceable electronic transfers can expose the seller to theft or non-payment. Platforms like escrow services, verified payment gateways, and secure peer-reviewed marketplaces can reduce these risks. From a personal security standpoint, meeting buyers in safe, public, or professionally monitored locations—such as banks or jeweler offices—is advisable. Sellers should also be cautious about sharing sensitive personal information, such as home addresses or financial details. In some cases, especially for high-value stones, law enforcement may recommend background checks or even security escorts. Being aware of scams, counterfeit payment methods, and fraudulent identity documents is essential. Beyond financial loss, failure to take precautions can result in legal entanglements if the diamond is later used in illegal activity. Legal counsel or police consultation is advisable if any red flags arise during the selling process.